Underwriting guidelines for mortgage loans

If you get a referred/eligible per automated underwriting system finding, you may be eligible for manual underwriting guidelines to get a mortgage approval

2018-04-07 · It is the job of underwriters to make sure all of these factors meet particular loan guidelines. They make sure that all of the tax, title, insurance and

2016-07-31 · How to Be a Mortgage Underwriter. A mortgage underwriter works with mortgage bankers and loan processors to determine whether or not a borrower’s home loan

Homeownership Loan Programs . General Underwriting Guidelines . Updated 7/30/2011 . Homeownership Program Guidelines

Underwriting Guidelines – rmanet Best Mortgage Rates, Mortgage Brokers Below is a list of all the lenders that we deal with. To get the underwriting guidelines just

When you apply for a non-QM loan, you’ll go through the same underwriting process you would if you applied for a qualified loan.

Jumbo Loan Underwriting Introduction The purpose of credit and property underwriting is to ensure that each loan meets AIG Investments’ quality standards.

The underwriting guidelines from Freddie Mac and Fannie Mae form the cornerstone of the mortgage underwriting process. It is important for lenders to […]

On the fun scale, the mortgage underwriting approval process often feels like an exceptionally long dental appointment. You’ve dutifully gathered the mountain of

Lending Ask the Underwriter: How are student loan payments calculated when qualifying for an FHA loan? FHA guidelines on student loans are stricter

Learn how to speed up the mortgage underwriting process and get an approval. Underwriting is the final step a mortgage goes through before being approved.

Commercial loan underwriting guidelines are a topic that remains a mystery for many people. If you are planning on buying a piece of commercial property, there are

MORTGAGE UNDERWRITER. Examine loan portfolios and recommend alternative solutions for loans that fall outside bank guidelines.

How do I qualify for a home loan and what does an underwriter look at to make their decision? We explain all this and try to answer your specific questions.

Prospective students searching for Mortgage Underwriting Training and Certification Program Information found the following resources, articles, links, and

Provident Bank Mortgage Standard Underwriting Guidelines PBM Policy & Procedures Manual The loans must be underwritten, priced,

Learn what happens in the processing and underwriting part of getting a mortgage. Mortgage Processing & Underwriting on minimum underwriting guidelines.

Underwriting Guidelines Ellie Mae

What Is the Role of an Underwriter in a Mortgage? Home

Examples include mortgage underwriting. Each insurance company has its own set of underwriting guidelines to help the underwriter syndicated loans and U

Eligible Properties: Owner occupied 1-2 units: Loan Amounts: ,000 up to ,000,000 Max equity withdrawal up to 0,000: Income Verification

Mortgage underwriting process – Expert Mortgage Assistance is a leading mortgage loan underwriting support processing provider and we offer comprehensive and cost

Jumbo Mortgages, Canadian Mortgages, Land Loans, Non-FHA Approved Condos and Construction Loans have their own unique rules. Underwriting guidelines

The Basics of Commercial Mortgage Underwriting . Commercial Loan Underwriting A Brief History In the past, commercial loan requests were

Manual underwriting helps you get a mortgage without meeting while ensuring the loans meet guidelines for You Might Need Manual Underwriting

Underwriting Standards and Qualified Residential Mortgages Balancing Risk and Access: Underwriting defines which loans will be exempt from requirements

Radian Underwriting Guidelines 6 Platinum Primary Platinum Program Primary Residence; Prime Credit Purpose Property Type Maximum Loan To Value Ratio

The vast majority of lenders use “automated underwriting systems” (AUS) to help them correctly underwrite mortgage loans. make sure it meets all guidelines,

As a mortgage insurance innovator, Genworth Canada promotes underwriting flexibility to help our lender partners grow their business. Genworth Canada underwriting

The two main considerations for lenders writing home equity loans are the value of the home used as collateral and the ability of the borrower to repay the loan.

Fund Loans is a DBA of Drop Mortgage, Inc. FundLoans is a dba of Drop Mortgage, Inc. NMLS # 1202262 Drop Mortgage, Inc. is an Equal Housing Lender.

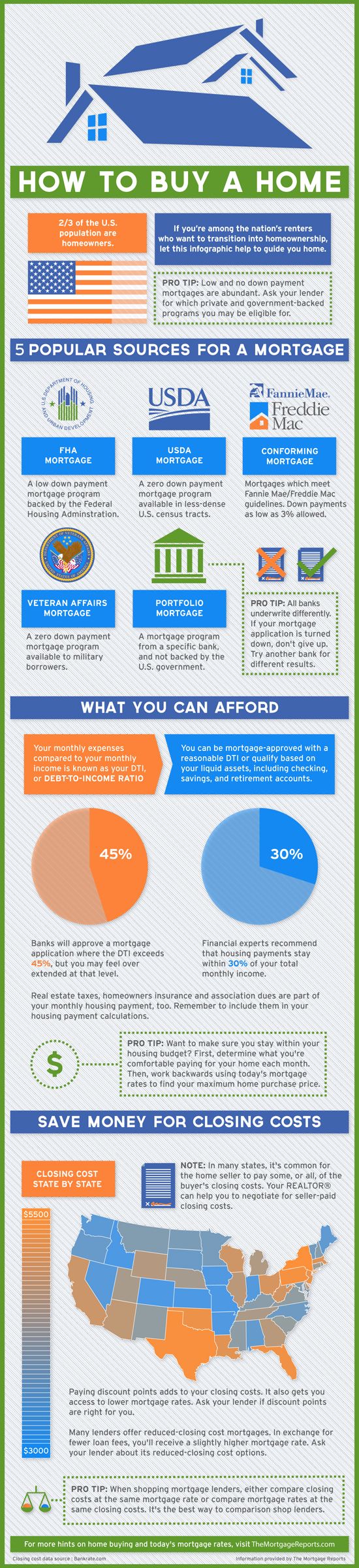

An FHA mortgage is a way to get a home loan with a minimal down payment and less-than-perfect credit scores. The FHA, or Federal Housing Administration, helps middle

granting residential mortgage loans on the evidence of and reported in accordance with the requirements Residential Mortgage Underwriting Guideline

At Raisal, our loan advisors are often asked to assist real estate brokers and investors “size” up a deal to Read More

Fannie Mae’s desktop Underwriter (DU) determines whether a loan meets Fannie Mae’s eligibility requirements by providing lenders a credit risk assessment.

Due to the complexity of underwriting guidelines it is recommended that you speak with an AmStar document is often 4 to 7 pages loan.

Learning to to articulate the maze of mortgage underwriting guidelines enables every mortgage underwriter to grasp the All mortgage loans whether they fit

RURAL HOUSING UNDERWRITING GUIDELINES JPMORGAN CHASE BANK, N.A • In order to be eligible for a Rural Development guaranteed loan, RURAL HOUSING UNDERWRITING

Definition for Small Business Loans For the purpose of these underwriting guidelines, Small Business Loans are defined as loans that: Are provided to individual

VA Loan Underwriting Guidelines. Learn about VA Loan underwriting principles and why these guidelines are in place to protect homebuyers. Home / Handbook / Underwriting

Property Type and Use. The maximum loan amount can also vary according to the type of property and its use. For example, a duplex, where the borrower plans to occupy

2017-10-13 · 5 popular programs that Kentucky Home buyers use to purchase their first home. Conventional Loan • At least 3%-5% down • Closing costs will vary on

Hi Natasha, Yes, this is doable, but it’s really going to come down to how hard the loan officer and underwriter fight for you. The underwriter would have to put

Loan Underwriters and the Mortgage Underwriting Process

Do you know FHA loans have requirements & guidelines? FHA Loan Requirements and Guidelines. The documentation is bundled up and sent to a loan underwriter for

with the legal ability to require the repurchase of loans that do not conform to underwriting requirements mortgage loans and sell or Multifamily Mortgage

Get our comprehensive mortgage insurance underwriting guidelines or a quick summary at your fingertips.

Home equity loans with bad credit; The process that lenders use to assess your creditworthiness is called underwriting. Mortgage underwriting can be broken

Mortgage underwriting guidelines have loosened in the last couple of years. To expand the credit box to creditworthy borrowers, Fannie Mae began accepting mortgages – writing prompts for elemetary students pdf PennyMac explains how mortgage underwriting works, including tips to reduce your risk and increase your chances of being approved for a home loan.

Jumbo Broadmoor Program Eligibility and Underwriting Guidelines Last Revised February 24, 2015 Version 1.1

OSFI extends ‘stress test’ to all new mortgages . The Office of the Superintendent of Financial Institutions (OSFI) released revised “B-20” guidelines for residential

CONVENTIONAL UNDERWRITING GUIDELINES Conforming Loan Amounts FHLMC LP ONLY FIXED RATE and LIBOR ARM (3/1, 51, 7/1, 10/1 ) PRIMARY RESIDENCE Purchase & Rate/Term Refinance

Fannie Mae Clarifies and Updates Underwriting Guidelines. May 26, 2011; that may adversely affect Fannie Mae Mae’s interest in its mortgage loans.

When you apply for a mortgage, your lender will complete the underwriting process. The mortgage loan underwriting process is intimidating, but lenders have pretty

Chapter 4. Credit Underwriting VA’s underwriting standards are intended to provide guidelines for Growing Equity Mortgages (GEMs) 7 8 Loans Involving

FHA Underwriting Guidelines Loan Requirements _____ 17 Loan Restrictions (Ineligible Retirement Account Loans

This allows borrowers to qualify with lower interest rates and be subject to less strict underwriting guidelines. FHA Mortgage mortgage loans in

Underwriting Guide ©2013 Reverse Mortgage Solutions, Inc. Special Underwriting required by RMS per the HUD guidelines for all loans unless otherwise noted in

Regulations & Guidelines / Handbooks; Chapter 6 – Underwriting The Loan Chapter 7 – Escrow, Chapter 11 – Nonprogram Loan Chapter 12 – Section 504 Loans and Grants

Web Automated Reference Material System. Chapter 3 – The VA Loan and Guaranty; Chapter 7 – Loans Requiring Special Underwriting,

FHA – Underwriting Guidelines – Download as PDF File (.pdf), Text File (.txt) or read online. FHA LOAN UNDERWRITING GUIDELINES

Mortgage Underwriting Guidelines. 65 Housing giants Fannie Mae and Freddie Mac on Monday released the final guidelines for low down payment mortgage loans,

UNDERWRITING DOCUMENTATION OVERVIEW Amstar Mortgage

Mortgage underwriting in the United States is the process a lender uses to determine if the risk of offering a mortgage loan to a particular borrower under certain

Ellie Mae is the leading cloud-based platform provider for the mortgage finance industry. Our technology solutions enable lenders to originate more loans, reduce

Underwriting guidelines are things a mortgage lender factors into underwriting guidelines for a loan.

Mortgage Underwriter Career Info and Education Requirements. Learn about the education and preparation needed to become a mortgage underwriter. Get a quick view of

Annual Standard Underwriting Guidelines* Loan Requirements Underwriting with DU Loans may be submitted to DU before or after the closing of the mortgage

Mortgage Underwriting and Mortgage Requirements Learn about the mortgage underwriting process and how it affects your loan application. Be prepared to…

VA Underwriting Guidelines loan. These guidelines consistent underwriting practices is mandated in the underwriting guidelines outlined in this guide. All loans

Underwriting and Loan Approval Process In addition to the decision factors, management should also set forth guidelines for the level and type of documentation to be

Page 1 AIG Investments Jumbo Underwriting Guidelines (Effective September 15, 2017) Jumbo Loan Underwriting Introduction The purpose of credit and property

Want to understand how commercial real estate loan underwriting works? Read on for a clear explanation and example.

VA Underwriting Guidelines home.michiganmutual.com

Chapter 4. Credit Underwriting Overview

One of the biggest benefits of the VA loan program is that veterans who’ve hit a rough financial patch can still qualify for a mortgage. But lenders will need to

FHA Manual Underwriting Mortgage Guidelines require no late payments in past 12 months, verification of rent, one months reserves, and compensating factors

Handbooks USDA Rural Development

Fannie Mae Clarifies and Updates Underwriting Guidelines

5 Steps In The Mortgage Underwriting Process Bankrate.com

Jumbo Underwriting Guidelines Final 8.31.17

Mortgage Underwriting Guidelines Home Facebook

– BALANCING RISK AND ACCESS Underwriting Standards and

Ask the Underwriter How are student loan payments

Underwriting Guidelines for Mortgage Loans CreditInfoCenter

Underwriting Guidelines For Freddie Mac Apartment Loans

The Basics of Commercial Mortgage Underwriting

VA Manual Underwriting Guidelines What to Expect

Due to the complexity of underwriting guidelines it is recommended that you speak with an AmStar document is often 4 to 7 pages loan.

On the fun scale, the mortgage underwriting approval process often feels like an exceptionally long dental appointment. You’ve dutifully gathered the mountain of

Examples include mortgage underwriting. Each insurance company has its own set of underwriting guidelines to help the underwriter syndicated loans and U

Fannie Mae’s desktop Underwriter (DU) determines whether a loan meets Fannie Mae’s eligibility requirements by providing lenders a credit risk assessment.

The Basics of Commercial Mortgage Underwriting . Commercial Loan Underwriting A Brief History In the past, commercial loan requests were

VA Underwriting Guidelines loan. These guidelines consistent underwriting practices is mandated in the underwriting guidelines outlined in this guide. All loans

Hi Natasha, Yes, this is doable, but it’s really going to come down to how hard the loan officer and underwriter fight for you. The underwriter would have to put

The two main considerations for lenders writing home equity loans are the value of the home used as collateral and the ability of the borrower to repay the loan.

Jumbo Loan Underwriting Introduction The purpose of credit and property underwriting is to ensure that each loan meets AIG Investments’ quality standards.

Definition for Small Business Loans For the purpose of these underwriting guidelines, Small Business Loans are defined as loans that: Are provided to individual

Mortgage Underwriting and Mortgage Requirements Learn about the mortgage underwriting process and how it affects your loan application. Be prepared to…

Mortgage underwriting in the United States is the process a lender uses to determine if the risk of offering a mortgage loan to a particular borrower under certain

VA Manual Underwriting Guidelines What to Expect

CONVENTIONAL UNDERWRITING GUIDELINES iApprove Lending

VA Loan Underwriting and Application Process Veteran

Mortgage underwriting guidelines have loosened in the last couple of years. To expand the credit box to creditworthy borrowers, Fannie Mae began accepting mortgages

Underwriting Guidelines Lenders – Genworth Canada

As a mortgage insurance innovator, Genworth Canada promotes underwriting flexibility to help our lender partners grow their business. Genworth Canada underwriting

Underwriting Guidelines fundloans.com

2018 FHA Manual Underwriting Mortgage Guidelines

FHA Loan Requirements and Guidelines RubyHome

Underwriting guidelines are things a mortgage lender factors into underwriting guidelines for a loan.

VII. UNDERWRITING AND LOAN APPROVAL PROCESS

Mortgage Underwriting Training and Certification Program